Roth 401k employer match calculator

This is because the IRS requires retirement savers to pay taxes on employer contributions. Use this calculator to help determine the best option for your retirement.

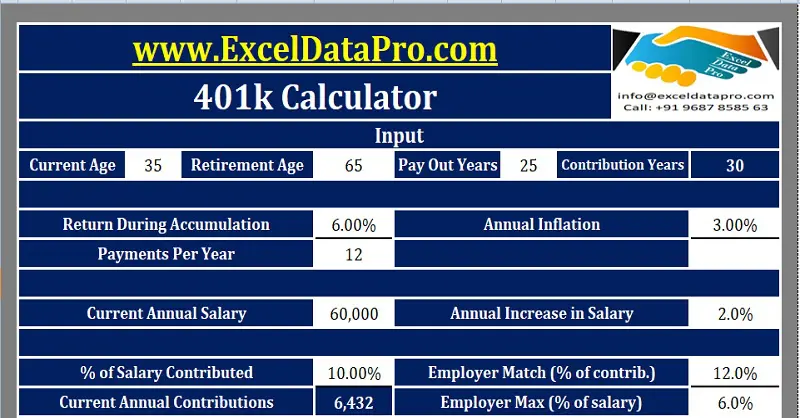

Free 401k Calculator For Excel Calculate Your 401k Savings

Roth IRAs are the only tax-sheltered retirement plans that do not impose RMDs.

. In contrast you can put 19500 into a Roth 401 k for 2021 and 20500 for 2022. Second many employers provide matching. For additional information see How to use the Contribution Calculator.

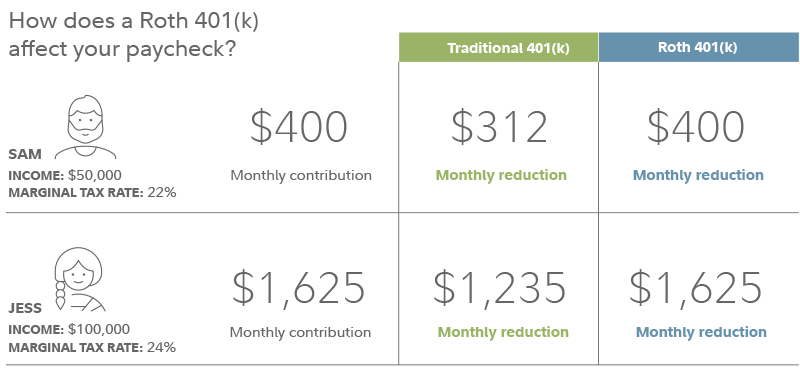

Roth 401 k plan withholding This is the percent of your gross income you put into a after tax retirement account such as a Roth 401 k. As of January 2006 there is a new type of 401 k contribution. While your plan may not have a deferral percentage.

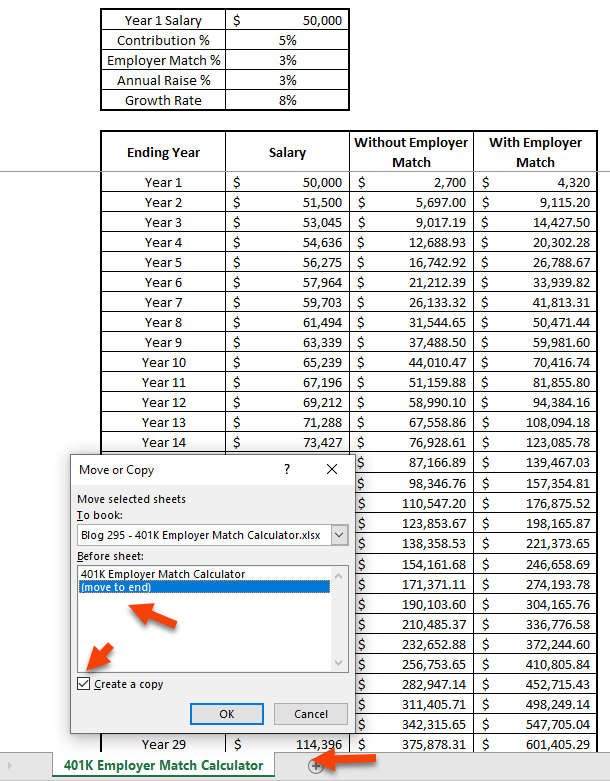

The 401 k s annual contribution limit of. The employer match helps you accelerate your retirement contributions. If your benefits see.

Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution. RMD for Roth IRAs unlike those required for traditional IRAs or 401ks. It provides you with two important advantages.

Employer Match Investment Returns Based on age an income of and current account of You will need about 6650 month in retirement Your 401 k will contribute 4850 month in. For example say you are paid monthly your annual salary is 72000 and you elect to contribute 5 percent to your Roth 401 plan. It provides you with two important advantages.

An individual can put 6000 into a Roth IRA per year or 7000 if over 50 in 2021 and 2022. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your. 401k Calculator A 401k can be one of your best tools for creating a secure retirement.

However matching contributions to a Roth 401k must be placed in a separate pre-tax 401k. Years until you retire. Contribution Calculator Current Contribution New Contribution Company Match Account Earnings 0 0 Show Details.

If your employer offers to match 050 of each dollar you contribute up to 6 of your pay they would add 1200 each year to your 401 account boosting your total annual. Traditional 401 k Calcuator. Updated May 2022 Roth vs.

Roth Retirement Savings Plan Modeler. Traditional 401 k and your Paycheck A 401 k can be an effective retirement tool. For example if you choose to contribute 4 of your salary to a 401.

Gematria is a calculator which have a set of. Use this calculator to determine which 401 k contribution type might be right for you. Related Retirement Calculator.

Some 401k match agreements match your contributions 100 while others match a different amount such as 50. Evaluate how much your employer will contribute. By changing any value in the following form fields calculated values are immediately provided for displayed output.

The employer will match 100 of your contributions generally up to a certain percentage of your salary. Divide 72000 by 12 to find your monthly gross. First all contributions and earnings to your 401 k are tax deferred.

For some investors this could prove to be a better option than the traditional 401 k where deposits are made on a pre-tax basis but are subject to taxes when the money is withdrawn. Roth 401 k vs. You only pay taxes on contributions and earnings when the money is.

The Roth 401 k brings together the best of a 401 k and the much-loved Roth IRA. A percentage of the employees own contribution and a.

Solved After Tax Roth 401 K Employee Deductions Company Contributions

Solo 401k Contribution Calculator Solo 401k

The Ultimate Roth 401 K Guide District Capital Management

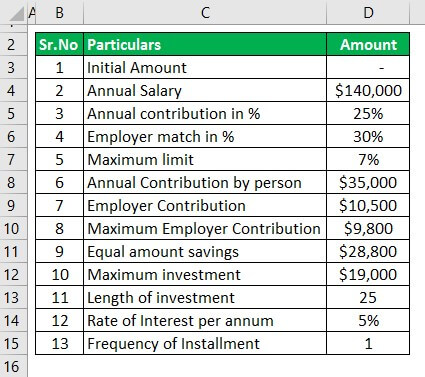

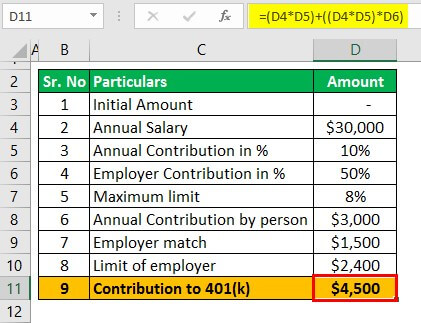

401k Contribution Calculator Step By Step Guide With Examples

401 K Calculator See What You Ll Have Saved Dqydj

401k Contribution Calculator Step By Step Guide With Examples

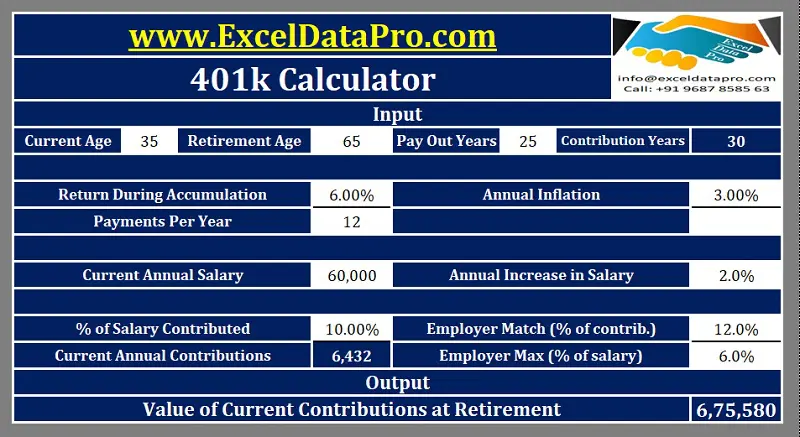

Download 401k Calculator Excel Template Exceldatapro

Excel 401 K Value Estimation Youtube

Toast Payroll 401 K Roth Simple Ira Employer Match Troubleshooting

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

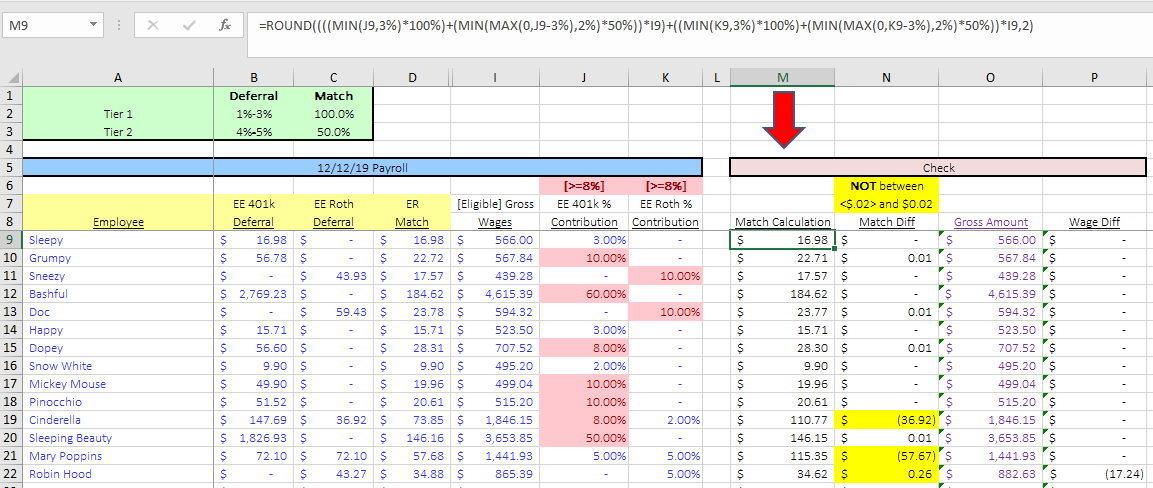

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

Take Control Of Your Own Destiny With This 401k Employer Match Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth 401k Roth Vs Traditional 401k Fidelity

Download 401k Calculator Excel Template Exceldatapro

401 K Plan What Is A 401 K And How Does It Work